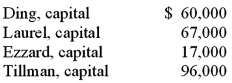

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold for $228,000, what is the minimum amount that Ding's creditors would have received?

A) $36,000.

B) $0.

C) $2,500.

D) $38,720.

E) $67,250.

Correct Answer:

Verified

Q7: When a partnership is insolvent and a

Q12: The Keaton, Lewis, and Meador partnership had

Q13: A local partnership was considering the possibility

Q14: A local partnership was in the process

Q15: The Henry, Isaac, and Jacobs partnership was

Q16: A local partnership was in the process

Q18: The Keaton, Lewis, and Meador partnership had

Q19: The Abrams, Bartle, and Creighton partnership began

Q25: The partnership of Rayne, Marin, and Fulton

Q29: Harding, Jones, and Sandy is in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents