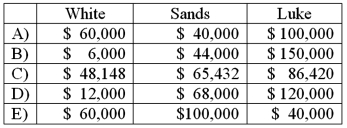

White, Sands, and Luke has the following capital balances and profit and loss ratios:

$60,000 (30%) ; $100,000 (20%) ; and $200,000 (50%) .

The partnership has received a predistribution plan.

How would $200,000 be distributed?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Q22: Which one of the following statements is

Q23: Which of the following statements is true

Q24: What accounting transactions are not recorded by

Q36: Gonda, Herron, and Morse is considering possible

Q39: A local partnership has assets of cash

Q41: The Amos, Billings, and Cleaver partnership had

Q42: A partnership held three assets: Cash, $13,000;

Q44: On January 1, 2011, the partners of

Q47: For a partnership, how should liquidation gains

Q56: Xygote, Yen, and Zen were partners who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents