Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

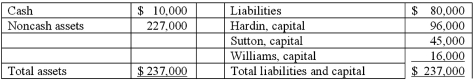

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: As of January 1, 2011, the partnership

Q51: Hardin, Sutton, and Williams have operated a

Q52: On January 1, 2011, the partners of

Q54: As of January 1, 2011, the partnership

Q55: On January 1, 2011, the partners of

Q57: Why is a Schedule of Liquidation prepared?

Q57: The Albert, Boynton, and Creamer partnership was

Q65: What should occur when a solvent partner

Q70: What events or circumstances might force the

Q71: What is a safe cash payment?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents