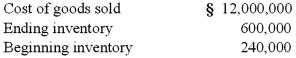

A U.S. company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2011:

The average exchange rate during 2011 was §1 = $.96. The beginning inventory was acquired when the exchange rate was §1 = $1.20. The ending inventory was acquired when the exchange rate was §1 = $.90. The exchange rate at December 31, 2011 was §1 = $.84. Assuming that the foreign nation for the subsidiary had a highly inflationary economy, at what amount should that foreign subsidiary's purchases have been reflected in the 2011 U.S. dollar income statement?

A) $11,865,600.

B) $11,577,600.

C) $11,520,000.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Q25: Which method of remeasuring a foreign subsidiary's

Q27: A net liability balance sheet exposure exists

Q33: A historical exchange rate for common stock

Q36: A U.S. company's foreign subsidiary had the

Q39: Which method of translating a foreign subsidiary's

Q42: A foreign subsidiary uses the first-in first-out

Q43: Esposito is an Italian subsidiary of a

Q45: Where is the disposition of a remeasurement

Q45: Esposito is an Italian subsidiary of a

Q49: When preparing a consolidation worksheet for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents