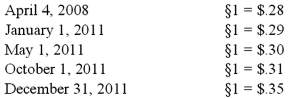

Boerkian Co. started 2011 with two assets: Cash of §26,000 (Stickles) and Land that originally cost §72,000 when acquired on April 4, 2008. On May 1, 2011, the company rendered services to a customer for §36,000, an amount immediately paid in cash. On October 1, 2011, the company incurred an operating expense of §22,000 that was immediately paid. No other transactions occurred during the year so an average exchange rate is not necessary. Currency exchange rates were as follows:

Assume that Boerkian was a foreign subsidiary of a U.S. multinational company and the stickle (§) was the functional currency of the subsidiary. Calculate the translation adjustment for this subsidiary for 2011 and state whether this is a positive or a negative adjustment.

Correct Answer:

Verified

Q82: Ginvold Co. began operating a subsidiary in

Q83: On January 1, 2011, Fandu Corp. began

Q84: Ginvold Co. began operating a subsidiary in

Q85: Boerkian Co. started 2011 with two assets:

Q87: Ginvold Co. began operating a subsidiary in

Q88: Boerkian Co. started 2011 with two assets:

Q89: On January 1, 2011, Veldon Co., a

Q90: Ginvold Co. began operating a subsidiary in

Q91: Boerkian Co. started 2011 with two assets:

Q100: Under what circumstances would the remeasurement of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents