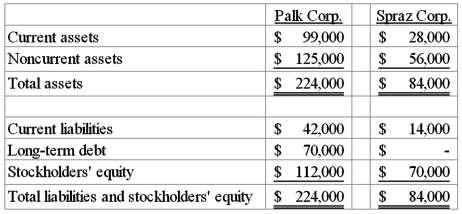

On January 1, 2010, Palk Corp. and Spraz Corp. had condensed balance sheets as follows:

On January 2, 2010, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2010. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.

What is consolidated current assets at January 2, 2010?

A) $127,000.

B) $129,800.

C) $143,800.

D) $148,000.

E) $135,400.

Correct Answer:

Verified

Q21: When a parent uses the acquisition method

Q24: When a subsidiary is acquired sometime after

Q26: When a parent uses the initial value

Q30: Royce Co. acquired 60% of Park Co.

Q31: On January 1, 2010, Palk Corp. and

Q32: Keefe, Inc., a calendar-year corporation, acquires 70%

Q33: Jax Company uses the acquisition method for

Q36: On January 1, 2010, Palk Corp. and

Q37: Royce Co. acquired 60% of Park Co.

Q40: On January 1, 2010, Palk Corp. and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents