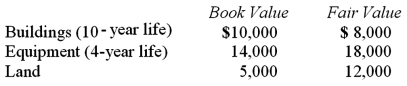

McGuire Company acquired 90 percent of Hogan Company on January 1, 2010, for $234,000 cash. This amount is reflective of Hogan's total fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.

In consolidation at December 31, 2010, what adjustment is necessary for Hogan's Buildings account?

A) $1,620 increase.

B) $1,620 decrease.

C) $1,800 increase.

D) $1,800 decrease.

E) No adjustment is necessary.

Correct Answer:

Verified

Q51: McGuire Company acquired 90 percent of Hogan

Q52: McGuire Company acquired 90 percent of Hogan

Q53: Pell Company acquires 80% of Demers Company

Q54: McGuire Company acquired 90 percent of Hogan

Q55: McGuire Company acquired 90 percent of Hogan

Q57: Pell Company acquires 80% of Demers Company

Q58: McGuire Company acquired 90 percent of Hogan

Q59: Pell Company acquires 80% of Demers Company

Q60: Pell Company acquires 80% of Demers Company

Q61: Pell Company acquires 80% of Demers Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents