Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2010. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life.

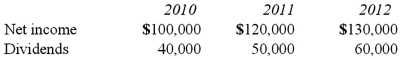

Demers earns income and pays dividends as follows:

Assume the partial equity method is applied.

Compute the non-controlling interest in Demers at December 31, 2012.

A) $107,800.

B) $140,000.

C) $80,000.

D) $160,800.

E) $146,800.

Correct Answer:

Verified

Q93: Pell Company acquires 80% of Demers Company

Q94: Pell Company acquires 80% of Demers Company

Q97: Pell Company acquires 80% of Demers Company

Q98: One company buys a controlling interest in

Q102: How is a noncontrolling interest in the

Q102: Caldwell Inc. acquired 65% of Club Corp.

Q104: Beta Corp. owns less than one hundred

Q105: On January 1, 2010, Glenville Co. acquired

Q106: Tosco Co. paid $540,000 for 80% of

Q112: How would you determine the amount of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents