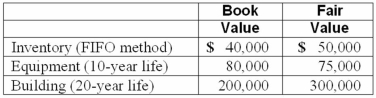

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2010. At that date, Glen owns only three assets and has no liabilities:

If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2010, what amount would be reflected in consolidated net income for 2010 as a result of the acquisition?

A) $20,000 under the initial value method.

B) $30,000 under the partial equity method.

C) $50,000 under the partial equity method.

D) $44,500 under the equity method.

E) $45,500 regardless of the internal accounting method used.

Correct Answer:

Verified

Q85: Watkins, Inc. acquires all of the outstanding

Q86: What accounting method requires a subsidiary to

Q89: Watkins, Inc. acquires all of the outstanding

Q92: For an acquisition when the subsidiary retains

Q92: Watkins, Inc. acquires all of the outstanding

Q97: What advantages might push-down accounting offer for

Q99: According to the FASB ASC regarding the

Q109: Avery Company acquires Billings Company in a

Q114: From which methods can a parent choose

Q119: For an acquisition when the subsidiary retains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents