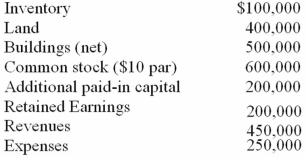

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account.

What will be the consolidated additional paid-in capital as a result of this acquisition?

A) $440,000.

B) $740,000.

C) $750,000.

D) $940,000.

E) $950,000.

Correct Answer:

Verified

Q47: On January 1, 20X1, the Moody Company

Q48: On January 1, 20X1, the Moody Company

Q49: On January 1, 20X1, the Moody Company

Q50: The financial statements for Goodwin, Inc., and

Q51: On January 1, 20X1, the Moody Company

Q53: The financial statements for Goodwin, Inc., and

Q54: Carnes has the following account balances as

Q55: On January 1, 20X1, the Moody Company

Q56: Carnes has the following account balances as

Q57: On January 1, 20X1, the Moody Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents