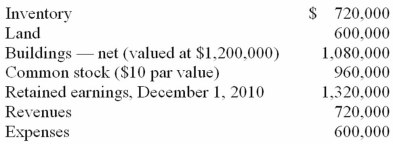

Salem Co. had the following account balances as of December 1, 2010:

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Assume that Bellington paid cash of $2.8 million. No stock is issued. An additional $50,000 is paid in direct combination costs.

Required:

For Goodwill, determine what balance would be included in a December 1, 2010 consolidation.

Correct Answer:

Verified

Q92: Fine Co. issued its common stock in

Q106: Describe the accounting for direct costs, indirect

Q107: Bale Co. acquired Silo Inc. on December

Q108: Salem Co. had the following account balances

Q110: How is contingent consideration accounted for in

Q110: Jernigan Corp. had the following account balances

Q112: The following are preliminary financial statements for

Q114: The financial statements for Jode Inc. and

Q114: What is the difference in consolidated results

Q118: On January 1, 2011, Chester Inc. acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents