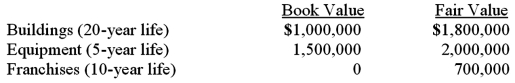

On January 4, 2011, Bailey Corp. purchased 40% of the voting common stock of Emery Co., paying $3,000,000. Bailey properly accounts for this investment using the equity method. At the time of the investment, Emery's total stockholders' equity was $5,000,000. Bailey gathered the following information about Emery's assets and liabilities whose book values and fair values differed:

Any excess of cost over fair value was attributed to goodwill, which has not been impaired. Emery Co. reported net income of $400,000 for 2011, and paid dividends of $200,000 during that year.

How much goodwill is associated with this investment?

A) $(500,000) .

B) $0.

C) $100,000.

D) $200,000.

E) $2,000,000.

Correct Answer:

Verified

Q42: On January 4, 2011, Mason Co. purchased

Q48: On January 4, 2011, Mason Co. purchased

Q55: Luffman Inc. owns 30% of Bruce Inc.

Q57: On January 1, 2010, Mehan, Incorporated purchased

Q61: Cayman Inc. bought 30% of Maya Company

Q63: Acker Inc. bought 40% of Howell Co.

Q64: Acker Inc. bought 40% of Howell Co.

Q65: On January 1, 2011, Jackie Corp. purchased

Q66: Cayman Inc. bought 30% of Maya Company

Q67: Cayman Inc. bought 30% of Maya Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents