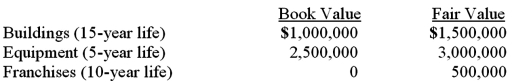

On January 1, 2011, Jackie Corp. purchased 30% of the voting common stock of Rob Co., paying $2,000,000. Jackie properly accounts for this investment using the equity method. At the time of the investment, Rob's total stockholders' equity was $3,000,000. Jackie gathered the following information about Rob's assets and liabilities whose book values and fair values differed:

Any excess of cost over fair value was attributed to goodwill, which has not been impaired. Rob Co. reported net income of $300,000 for 2011, and paid dividends of $100,000 during that year.

What is the amount of excess amortization expense for Jackie Corp's investment in Rob Co. for year 2011?

A) $0.

B) $30,000.

C) $40,000.

D) $55,000.

E) $60,000.

Correct Answer:

Verified

Q70: On January 4, 2011, Bailey Corp. purchased

Q71: Cayman Inc. bought 30% of Maya Company

Q72: Acker Inc. bought 40% of Howell Co.

Q73: On January 1, 2011, Jackie Corp. purchased

Q74: On January 4, 2011, Mason Co. purchased

Q76: Acker Inc. bought 40% of Howell Co.

Q77: On January 4, 2011, Bailey Corp. purchased

Q78: Cayman Inc. bought 30% of Maya Company

Q79: Cayman Inc. bought 30% of Maya Company

Q80: Acker Inc. bought 40% of Howell Co.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents