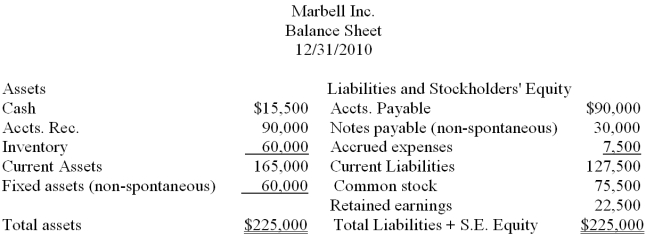

The following is the balance sheet for 2010 for Marbell Inc.

Sales for 2010 were $500,000. Sales for 2011 have been projected to increase by 10%. Assuming that Marbell Inc. is operating below capacity, calculate the amount of new funds required to finance this growth. Marbell has an 8% return on sales and 80% is paid out as dividends.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: A lower dividend payout ratio will decrease

Q39: As the dividend payout ratio declines, more

Q40: The percent-of-sales forecast is likely to be

Q41: Level production schedules usually have the advantage

Q77: An increase in sales accompanied by an

Q82: Eddie's Bar and Restaurant Supplies expects its

Q83: During 20XX, Baker Company and Baumer Company

Q84: Match the following with the items below:

Q85: Frank's Sporting Goods projects sales for the

Q85: The Amber Magic Shoppe has forecast its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents