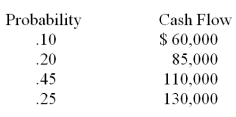

Cooper Construction is considering purchasing new, technologically advanced equipment. The equipment will cost $640,000 with a salvage value of $75,000 at the end of its useful life of 10 years. The equipment is expected to generate additional annual cash inflows with the following probabilities for the next ten years:

a) What is the expected cash flow?

b) Cooper's cost of capital is 10%. What is the expected net present value?

c) Should Cooper buy the equipment?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: A correlation coefficient of zero indicates

A) the

Q81: When considering the efficient frontier, financial managers

Q82: A correlation coefficient of _ provides the

Q82: Bill Broodiest, star quarterback for the Spring

Q84: The "efficient frontier" indicates

A) alternatives with neutral

Q84: Which of the following combinations of investments

Q86: All of the following are methods of

Q87: Golden Corporation is considering the purchase of

Q88: A project that carries a normal amount

Q90: Match the following with the items below:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents