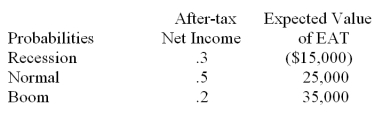

Golden Corporation is considering the purchase of new equipment costing $77,000. The expected life of the equipment is 10 years. The potential increase in annual net income from the new equipment for the next 10 years depends on the state of the economy as follows.  The equipment will be depreciated using straight line depreciation. Golden's cost of capital is 12%. What is the expected NPV? Should they purchase the new equipment?

The equipment will be depreciated using straight line depreciation. Golden's cost of capital is 12%. What is the expected NPV? Should they purchase the new equipment?

Correct Answer:

Verified

Q80: A correlation coefficient of zero indicates

A) the

Q81: When considering the efficient frontier, financial managers

Q82: A correlation coefficient of _ provides the

Q82: Bill Broodiest, star quarterback for the Spring

Q84: The "efficient frontier" indicates

A) alternatives with neutral

Q84: Which of the following combinations of investments

Q86: All of the following are methods of

Q88: A project that carries a normal amount

Q89: Cooper Construction is considering purchasing new, technologically

Q90: Match the following with the items below:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents