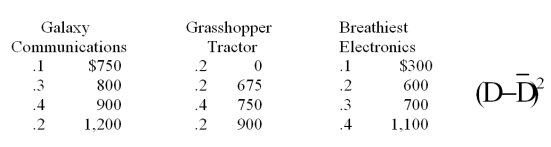

Bill Broodiest, star quarterback for the Spring Bay Smashers, would like to invest a small portion of his earnings in stocks of one of three firms. His estimated returns and the probabilities of their occurrence follow.

a) Calculate the expected return for each stock.

b) Calculate the coefficient of variation for each stock.

c) Rank the three from the least risky to the most risky.

d) Which stock would you recommend to Bill?

Correct Answer:

Verified

Q78: A correlation coefficient of _ provides the

Q78: A "what if" simulation using a computer

Q78: The "portfolio effect" in capital budgeting refers

Q80: A correlation coefficient of zero indicates

A) the

Q81: When considering the efficient frontier, financial managers

Q82: A correlation coefficient of _ provides the

Q84: Which of the following combinations of investments

Q84: The "efficient frontier" indicates

A) alternatives with neutral

Q86: All of the following are methods of

Q87: Golden Corporation is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents