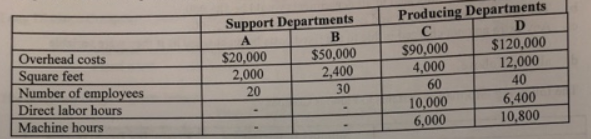

Lopez Manufacturing prices its products at full cost plus 40 percent.The company operates two support departments and two producing departments.Budgeted costs and normal activity levels are as follows:  Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees.Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees.Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

One of the products the company produces requires 4 direct labor hours per unit in Department C and no time in Department D. Direct materials for the product cost $45 per unit, and direct labor is $20 per unit.

If the direct method of allocation is used and the company follows its usual pricing policy, the selling price of the product would be

A) $161.00.

B) $115.00.

C) $111.00.

D) $102.00.

Correct Answer:

Verified

Q63: Plants Company has two support departments (S1

Q64: Staff Company allocates common Building Department costs

Q65: Which of the following allocation methods fully

Q67: Savings Bank of Lawrence has three revenue-generating

Q69: Rust Company has two support departments (S1

Q70: Jacob Company has two support departments, Maintenance

Q71: Savings Bank of Lawrence has three revenue-generating

Q72: Jacob Company has two support departments, Maintenance

Q73: Rust Company has two support departments (S1

Q89: Which of the following would NOT be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents