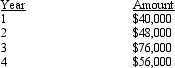

A capital investment project requires an investment of $100,000 and has an expected life of four years.Annual cash flows at the end of each year are expected to be as follows:  Ignoring income taxes, the net present value of the project using a 6 percent discount rate is

Ignoring income taxes, the net present value of the project using a 6 percent discount rate is

A) $88,632.

B) $24,792.

C) $68,296.

D) $(28,296) .

Correct Answer:

Verified

Q12: Which of the following methods consider the

Q48: Jones Company is considering the purchase of

Q48: A firm is considering a project with

Q49: Clemens Company is considering the purchase of

Q51: Springer Company is considering the purchase of

Q52: Cooper Industries is considering a project that

Q57: The following information pertains to an investment:

Q58: Springer Company is considering the purchase of

Q67: The present value of $20,000 to be

Q123: The internal rate of return is defined

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents