Bert Corporation is considering an investment in equipment for $150,000.

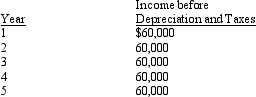

Data related to the investment are as follows:

Cost of capital is 10 percent.

Cost of capital is 10 percent.

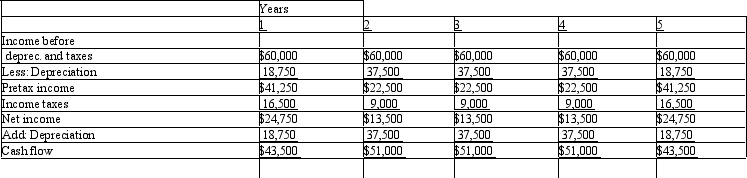

Bert uses the straight-line method of depreciation with mid-year convention for tax purposes.In addition, its tax rate is 40 percent and the depreciable life of the equipment is four years with no salvage value.The equipment is sold at the end of the fifth year.

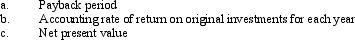

Required:

Determine the following amounts using after-tax cash flows:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Under the current tax law, an asset

Q81: Billings Office Services is considering the purchase

Q82: Van Dyke Company is evaluating a capital

Q83: Barker Production Company is considering the purchase

Q85: Blanshan Company is considering the purchase of

Q86: Information about a project Darcy Company is

Q88: Blanshan Company is considering the purchase of

Q89: Fill in the lettered blanks in the

Q103: Under the current tax law, an asset

Q106: A postaudit compares

A)estimated benefits and costs with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents