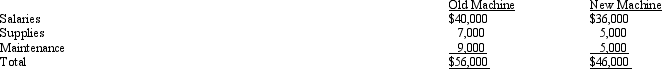

Dale Davis Company is evaluating a proposal to purchase a new machine that would cost $100,000 and have a salvage value of $10,000 in four years.It would provide annual operating cash savings of $10,000, as follows:

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000.If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000.The old machine's present book value is $40,000.If kept, in one year the old machine will require repairs predicted to cost $35,000.

If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000.If the new machine is not purchased, the old machine will be disposed of in four years at a predicted salvage value of $2,000.The old machine's present book value is $40,000.If kept, in one year the old machine will require repairs predicted to cost $35,000.

Dale Davis's cost of capital is 14 percent.

Required:

Should the new machine be purchased? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Blanshan Company is considering the purchase of

Q89: Fill in the lettered blanks in the

Q90: A capital investment project requires an investment

Q93: Brown Company is considering the purchase of

Q94: Blanshan Company is considering the purchase of

Q95: Local Construction Company is considering the purchase

Q96: Jackson Company is considering a project that

Q97: Explain what a capital investment decision is.

Q106: A postaudit compares

A)estimated benefits and costs with

Q119: What are the differences that affect capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents