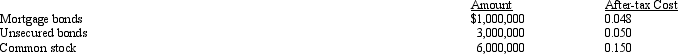

Young Company has a tax rate of 40 percent.Information for the company is as follows:

- What is the EVA if the before-tax operating income is $1,500,000?

A) $1,134,000

B) $402,000

C) $534,000

D) $(198,000)

Correct Answer:

Verified

Q36: The following information pertains to the three

Q37: The following information pertains to the three

Q38: Correll Company has two divisions, A and

Q39: Parker Corporation had sales of $250,000, income

Q40: Correll Company has two divisions, A and

Q42: Correll Company has two divisions, A and

Q43: Beta Division had the following information:

Q46: Young Company has a tax rate of

Q65: Which of the following is NOT a

Q74: Return on investment can be divided into

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents