A five-year lease is signed by the City of Wachovia for equipment with a seven-year life. The asset will be returned to the lessor at the end of the lease. The present value of the lease is $20,000, and annual payments of $5,411.41 are payable beginning on the date the lease is signed. The interest portion of the second payment is $1,604.75. The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

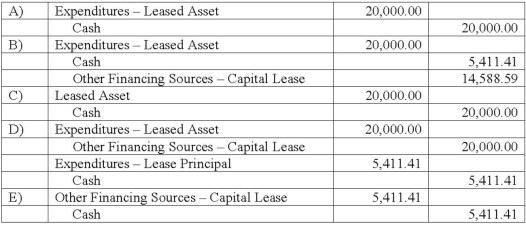

What should be recorded in the General Fund on the date the lease is signed?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Q4: What are the three broad sections of

Q8: Jones College, a public institution of higher

Q9: Drye Township has received a donation of

Q10: Which of the following must be presented

Q11: Which criteria must be met to be

Q13: A method of depreciation for infrastructure assets

Q16: GASB Codification Section 2200.106-107 makes which of

Q17: Which of the following is not a

Q18: For fund financial statements, what account is

Q20: According to the GASB (Governmental Accounting Standards

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents