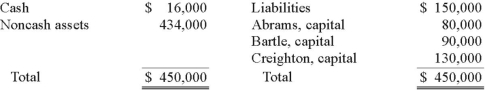

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:  Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

The noncash assets were sold for $134,000. Which partner(s) would have had to contribute assets to the partnership to cover a deficit in his or her capital account?

A) Abrams.

B) Bartle.

C) Creighton.

D) Abrams and Creighton.

E) Abrams and Bartle.

Correct Answer:

Verified

Q2: A local partnership was considering the possibility

Q3: Dancey, Reese, Newman, and Jahn were partners

Q4: A local partnership was considering the possibility

Q5: A local partnership was considering the possibility

Q6: A local partnership was considering the possibility

Q8: The Keaton, Lewis, and Meador partnership had

Q9: A local partnership was in the process

Q10: The Abrams, Bartle, and Creighton partnership began

Q11: A local partnership was in the process

Q12: The Abrams, Bartle, and Creighton partnership began

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents