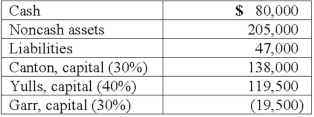

As of January 1, 2013, the partnership of Canton, Yulls, and Garr had the following account balances and percentages for the sharing of profits and losses:

The partnership incurred losses in recent years and decided to liquidate. The liquidation expenses were expected to be $10,000.

How much of the existing cash balance could be distributed safely to partners at this time?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: The partnership of Rayne, Marin, and Fulton

Q33: The Arnold, Bates, Carlton, and Delbert partnership

Q39: A local partnership has assets of cash

Q40: Which of the following statements is false

Q42: As of January 1, 2013, the partnership

Q42: A partnership had the following account balances:

Q45: On January 1, 2013, the partners of

Q47: For a partnership, how should liquidation gains

Q57: The Albert, Boynton, and Creamer partnership was

Q71: What is a safe cash payment?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents