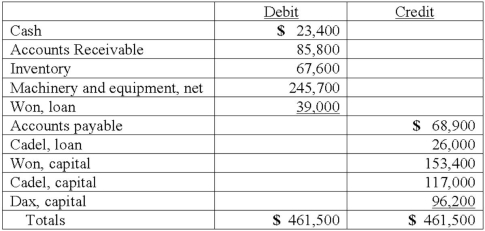

On January 1, 2013, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:

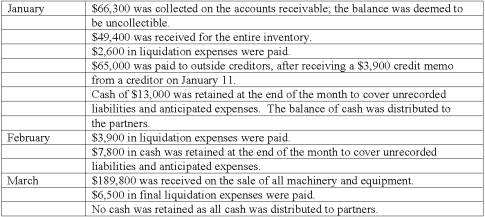

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Correct Answer:

Verified

Q25: The partnership of Rayne, Marin, and Fulton

Q42: A partnership had the following account balances:

Q45: On January 1, 2013, the partners of

Q47: For a partnership, how should liquidation gains

Q52: A partnership held three assets: Cash, $13,000;

Q53: The Amos, Billings, and Cleaver partnership had

Q55: As of January 1, 2013, the partnership

Q57: The Albert, Boynton, and Creamer partnership was

Q65: What should occur when a solvent partner

Q66: What is the purpose of a predistribution

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents