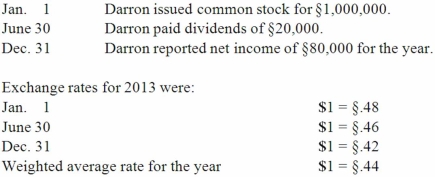

Darron Co. was formed on January 1, 2013 as a wholly owned foreign subsidiary of a U.S. corporation. Darron's functional currency was the stickle (§) . The following transactions and events occurred during 2013:  What exchange rate should have been used in translating Darron's revenues and expenses for 2013?

What exchange rate should have been used in translating Darron's revenues and expenses for 2013?

A) $1 = §.48.

B) $1 = §.44.

C) $1 = §.46.

D) $1 = §.42.

E) $1 = §.45.

Correct Answer:

Verified

Q5: A subsidiary of Porter Inc., a U.S.

Q6: Dilty Corp. owned a subsidiary in France.

Q7: Westmore Ltd., is a British subsidiary of

Q8: Darron Co. was formed on January 1,

Q9: The translation adjustment from translating a foreign

Q11: Sinkal Co. was formed on January 1,

Q12: Certain balance sheet accounts of a foreign

Q13: Certain balance sheet accounts of a foreign

Q14: What is a company's functional currency?

A) the

Q15: Westmore Ltd., is a British subsidiary of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents