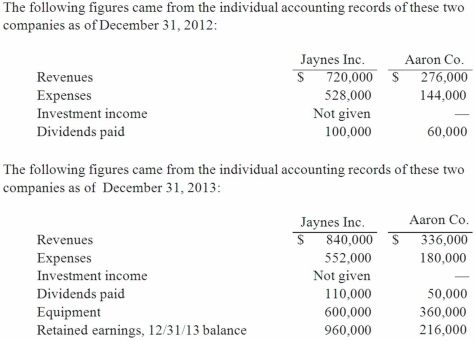

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What balance would Jaynes' Investment in Aaron Co. account have shown on December 31, 2012, when the equity method was applied for this acquisition?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: On 4/1/11, Sey Mold Corporation acquired 100%

Q113: Fesler Inc. acquired all of the outstanding

Q114: Jaynes Inc. acquired all of Aaron Co.'s

Q114: For each of the following situations, select

Q115: Why is push-down accounting a popular internal

Q116: Utah Inc. acquired all of the outstanding

Q117: On January 1, 2011, Rand Corp. issued

Q119: Jaynes Inc. acquired all of Aaron Co.'s

Q122: Dutch Co. has loaned $90,000 to its

Q122: On 4/1/11, Sey Mold Corporation acquired 100%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents