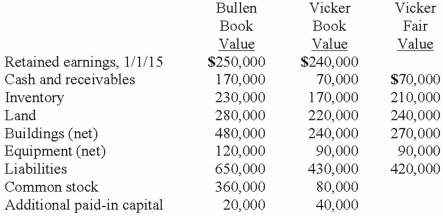

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 2013. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:  Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

A) $440,000, $496,000.

B) $440,000, $520,000.

C) $425,000, $505,000.

D) $400,000, $500,000.

E) $427,000, $510,000.

Correct Answer:

Verified

Q8: Which one of the following is a

Q9: Prior to being united in a business

Q10: Bullen Inc. acquired 100% of the voting

Q11: Using the acquisition method for a business

Q12: Bullen Inc. acquired 100% of the voting

Q14: An example of a difference in types

Q15: Lisa Co. paid cash for all of

Q16: How are direct and indirect costs accounted

Q17: Which one of the following is a

Q18: Direct combination costs and stock issuance costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents