Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

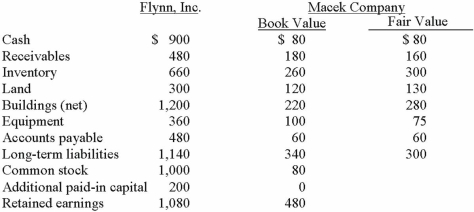

The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.

What amount will be reported for consolidated inventory?

A) $1,000,000.

B) $960,000.

C) $920,000.

D) $660,000.

E) $620,000.

Correct Answer:

Verified

Q75: Flynn acquires 100 percent of the outstanding

Q76: Presented below are the financial balances for

Q77: Presented below are the financial balances for

Q78: Flynn acquires 100 percent of the outstanding

Q79: Flynn acquires 100 percent of the outstanding

Q92: Fine Co. issued its common stock in

Q101: Goodwill is often acquired as part of

Q104: How are direct combination costs, contingent consideration,

Q106: Describe the accounting for direct costs, indirect

Q117: What is the primary difference between recording

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents