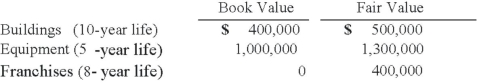

On January 3, 2013, Austin Corp. purchased 25% of the voting common stock of Gainsville Co., paying $2,500,000. Austin decided to use the equity method to account for this investment. At the time of the investment, Gainsville's total stockholders' equity was $8,000,000. Austin gathered the following information about Gainsville's assets and liabilities:  For all other assets and liabilities, book value and fair value were equal. Any excess of cost over fair value was attributed to goodwill, which has not been impaired.

For all other assets and liabilities, book value and fair value were equal. Any excess of cost over fair value was attributed to goodwill, which has not been impaired.

What is the amount of goodwill associated with the investment?

A) $500,000.

B) $200,000.

C) $0.

D) $300,000.

E) $400,000.

Correct Answer:

Verified

Q10: Club Co. appropriately uses the equity method

Q11: A company should always use the equity

Q12: Atlarge Inc. owns 30% of the outstanding

Q13: On January 1, 2013, Jordan Inc. acquired

Q14: On January 1, 2013, Deuce Inc. acquired

Q16: On January 1, 2013, Deuce Inc. acquired

Q17: Atlarge Inc. owns 30% of the outstanding

Q18: Tower Inc. owns 30% of Yale Co.

Q19: On January 1, 2013, Pacer Company paid

Q20: Gaw Company owns 15% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents