On January 1, 2012, Mehan, Incorporated purchased 15,000 shares of Cook Company for $150,000 giving Mehan a 15% ownership of Cook. On January 1, 2013 Mehan purchased an additional 25,000 shares (25%) of Cook for $300,000. This last purchase gave Mehan the ability to apply significant influence over Cook. The book value of Cook on January 1, 2012, was $1,000,000. The book value of Cook on January 1, 2013, was $1,150,000. Any excess of cost over book value for this second transaction is assigned to a database and amortized over five years.

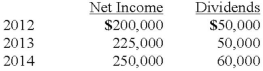

Cook reports net income and dividends as follows. These amounts are assumed to have occurred evenly throughout the years:

On April 1, 2014, just after its first dividend receipt, Mehan sells 10,000 shares of its investment.

How much income did Mehan report from Cook during 2013?

A) $90,000.

B) $110,000.

C) $67,500.

D) $87,500.

E) $78,750.

Correct Answer:

Verified

Q42: On January 3, 2013, Roberts Company purchased

Q43: On January 1, 2013, Anderson Company purchased

Q44: On January 3, 2013, Roberts Company purchased

Q45: On January 1, 2012, Mehan, Incorporated purchased

Q46: On January 1, 2013, Anderson Company purchased

Q48: On January 4, 2013, Mason Co. purchased

Q49: On January 4, 2012, Harley, Inc. acquired

Q50: On January 1, 2012, Mehan, Incorporated purchased

Q51: On January 4, 2012, Harley, Inc. acquired

Q52: On January 1, 2012, Mehan, Incorporated purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents