The Black-Scholes-Merton model for European puts, obtained by applying put-call parity to the Black-Scholes-Merton model for European calls, is customarily expressed by which of the following:

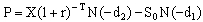

A)

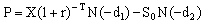

B)

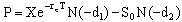

C)

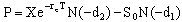

D)

E) none of the above

Correct Answer:

Verified

Q22: What happens when the volatility is zero

Q23: The Black-Scholes-Merton model is the discrete time

Q24: Which of the following statements is incorrect

Q26: The relationship between the option price and

Q28: The option's rate of time value decay

Q29: The option's delta is approximately the change

Q32: Which of the following statements about the

Q34: The values of N(d1)and N(d2)are called risk

Q35: The pattern of volatility across exercise prices

Q39: The Black-Scholes-Merton model assumes that the volatility

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents