The following information pertains to questions

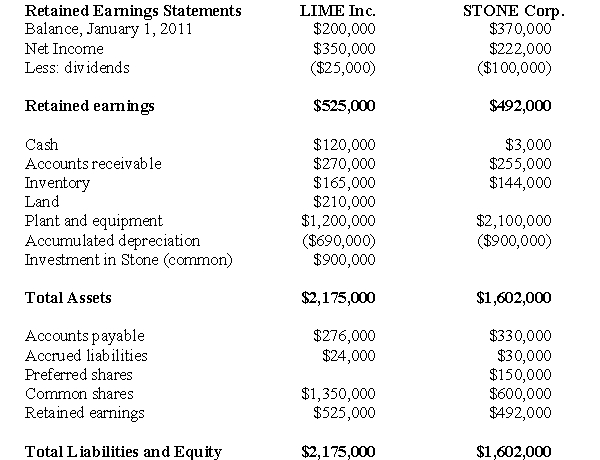

The financial statements of Lime Inc.and its subsidiary Stone Corp.on December 31,2011 are shown below:  Other Information:

Other Information:

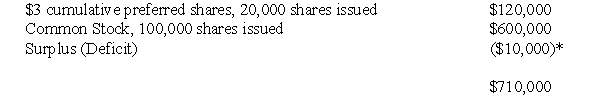

On January 1,2008 Stone's balance sheet showed the following shareholders equity:  On this date,Lime acquired 80,000 common shares for $900,000.

On this date,Lime acquired 80,000 common shares for $900,000.

* Stone's preferred share dividends were one year in arrears on that date.

Stone's Fair Values approximated its book values on that date with the following exceptions:

Inventory had a fair value that was $30,000 higher than its book value.Plant and equipment had a fair value $10,000 lower than their book value.

The plant and equipment had an estimated remaining useful life of 10 years from the date of acquisition.

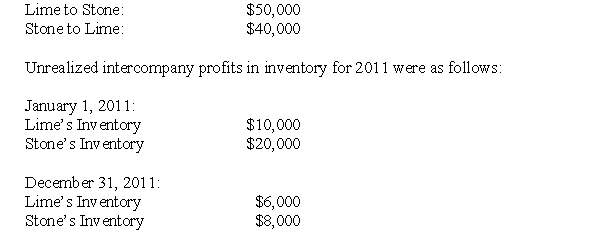

Intercompany sales of inventory for the year were as follows:  On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

On January 1,2009,Stone sold equipment to Lime for $30,000.The equipment had a carrying value of $25,000 on that date and an estimated useful life of 3 years.The inventory on hand at the start of 2011 was sold to outsiders during the year.Both companies are subject to a tax rate of 40%.There were no dividends in arrears on December 31,2011.Lime uses the cost method to account for its investment in Stone.

-Prepare Lime's December 31,2011 Consolidated Balance Sheet.

Correct Answer:

Verified

Q37: Any unallocated portion of the difference between

Q38: The following information pertains to questions

Whine

Q39: P Corp.owns 800 of Q Corp.'s 1,000

Q40: The following information pertains to questions

The

Q41: Which of the following statements pertaining to

Q42: Compute the Goodwill on the date of

Q44: Which of the following statements pertaining to

Q45: The following information pertains to questions

Whine

Q46: The following information pertains to questions

The

Q47: The following information pertains to questions

Whine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents