The following information pertains to questions

X Inc.owns 80% of Y Inc.During 2009,X Inc sold inventory to Y for $10,000.Half of this inventory remained in Y's warehouse at year end.Half of this inventory remained in Y's warehouse at year end.Also during 2009,Y Inc sold Inventory to X Inc.for $5,000.40% of this inventory remained in X's warehouse at year end.Both companies are subject to a tax rate of 50%.The gross profit percentage on sales is 20% for both companies.Unless otherwise stated,assume X Inc.uses the cost method to account for its Investment in Y.Inc.

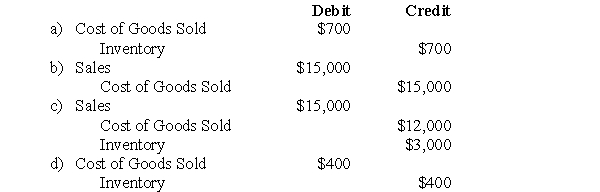

-What would be the journal entry to eliminate any unrealized profits from the Consolidated Financial Statements during the year?

Correct Answer:

Verified

Q9: The following information pertains to questions

X Inc.owns

Q10: The following information pertains to questions

X Inc.owns

Q11: What would be the journal entry to

Q12: Which of the following theories does NOT

Q15: Under which of the following Theories is

Q16: Under which of the following Consolidation Theories

Q17: Which of the following theories views non-controlling

Q18: The following information pertains to questions

X Inc.owns

Q19: The amount of goodwill arising from this

Q20: When are profits from intercompany land sales

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents