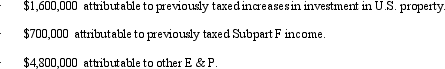

Benchmark,Inc. ,a U.S.shareholder owns 100% of a CFC from which Benchmark receives a $3 million cash distribution.The CFC's E & P is composed of the following amounts.

Benchmark recognizes a taxable dividend of:

A) $3 million.

B) $700,000.

C) $2,300,000.

D) $0.

Correct Answer:

Verified

Q43: The U.S.system for taxing income earned outside

Q58: BlueCo,a domestic corporation,incorporates its foreign branch in

Q61: BoxCo,Inc. ,a domestic corporation,owns 10% of the

Q65: In which of the following independent situations

Q66: Rufus,Inc. ,a domestic corporation,has worldwide taxable income

Q71: Which of the following income items do

Q75: Which of the following transactions by a

Q76: Amelia,Inc. ,a domestic corporation receives a $100,000

Q77: ForCo,a controlled foreign corporation,earns $500,000 in net

Q78: Amelia,Inc. ,a domestic corporation,has worldwide taxable income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents