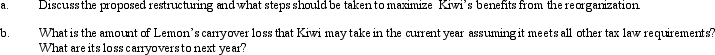

Kiwi Corporation would like to acquire Lemon Corporation on October 31 in a tax-free reorganization.While Kiwi is not interested in Lemon's line of business,Kiwi finds Lemon particularly appealing because Lemon has a $600,000 NOL and $20,000 capital loss carryover.Kiwi is a very profitable corporation and is also expecting to have at least $500,000 of capital gains for the current year.At the time of the restructuring,Lemon has assets valued at $3 million (basis of $3.3 million)and Kiwi could use most of these assets in its business.However,Kiwi would rather sell the assets,recognize the loss to offset its expected gains,and then use the proceeds to purchase new equipment.Kiwi is proposing exchanging 25% of its stock for all of Lemon's assets.The long-term tax-exempt rate is currently 6%,and Kiwi's discount factor for making investment decisions is 10%.

Correct Answer:

Verified

Q51: Cocoa Corporation is acquiring Milk Corporation in

Q83: Avocado Corporation and Tomato Corporation want to

Q97: Lyon has 100,000 shares outstanding that are

Q107: Explain how the tax treatment for parties

Q109: NewCo received all of DebtCo's assets (value

Q110: Iron Corporation was created 10 years ago.

Q113: Once a gain is recognized in a

Q122: Explain when the IRS would use §

Q126: When a corporation has an ownership change,the

Q128: Tuna Corporation is very interested in acquiring

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents