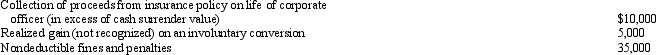

Red Corporation,a calendar year taxpayer,has taxable income of $600,000.Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes,Red Corporation's current E & P is:

A) $565,000.

B) $575,000.

C) $580,000.

D) $650,000.

E) None of the above.

Correct Answer:

Verified

Q42: The tax treatment of corporate distributions at

Q43: Beige Corporation (a calendar year taxpayer)has taxable

Q46: Blue Corporation, a cash basis taxpayer, has

Q47: On January 2,2010,Orange Corporation purchased equipment for

Q50: Pheasant Corporation ended its first year of

Q52: Mallard Corporation is a calendar year taxpayer

Q61: Renee, the sole shareholder of Indigo Corporation,

Q62: During the current year,Gander Corporation sold equipment

Q70: Which of the following statements is incorrect

Q78: Glenda is the sole shareholder of Condor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents