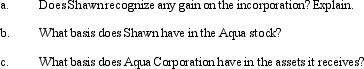

Shawn,a sole proprietor,is engaged in a service business and uses the cash basis of accounting.In the current year,Shawn incorporates his business by forming Aqua Corporation.In exchange for all of its stock,Aqua receives: assets (basis of $380,000 and fair market value of $1.8 million),trade accounts payable of $125,000,and loan due to a bank of $375,000.The proceeds from the bank loan were used by Shawn to provide operating funds for the business.Aqua Corporation assumes all of the liabilities transferred to it.

Correct Answer:

Verified

Q84: What is the rationale underlying the tax

Q85: Trish and Ron form Pine Corporation. Trish

Q89: Issues relating to basis arise when a

Q91: Lark City donates land worth $300,000 and

Q91: What are the tax consequences if an

Q92: Tan Corporation desires to set up a

Q101: Stock in Merlin Corporation is held equally

Q104: When forming a corporation, a transferor-shareholder may

Q105: Joyce, a single taxpayer, transfers property (basis

Q106: Four years ago, Don, a single taxpayer,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents