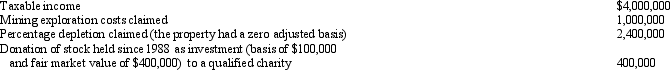

In 2010,Jay Corporation (a calendar year taxpayer) had the following transactions:

For 2010,Jay Corporation's AMTI is:

A) $6,900,000.

B) $7,150,000.

C) $7,250,000.

D) $7,300,000.

E) None of the above.

Correct Answer:

Verified

Q56: A corporation has the following items related

Q57: Which statement is false?

A)The stock ownership requirement

Q58: The penalty tax in 2010 for AET

Q59: Tayshaun,Inc. ,manufactures and sells glassware.The company also

Q60: Bacon Corporation manufactures an exercise machine at

Q60: Which of the following items will be

Q66: Azure Corporation incurred the following taxes for

Q77: Which statement is false?

A)The starting point for

Q91: Which of the following items will be

Q92: Which entity is subject to the ACE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents