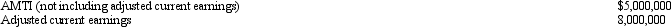

During 2010,Brown Corporation (a calendar year taxpayer) has $4,000,000 of taxable income and the following transactions:

Brown Corporation's alternative minimum tax (AMT) for 2010 is:

A) $90,000.

B) $500,000.

C) $700,000.

D) $1,360,000.

E) None of the above.

Correct Answer:

Verified

Q59: For purposes of the penalty tax on

Q60: Which of the following items will be

Q66: Azure Corporation incurred the following taxes for

Q67: Which statement,if any,is false?

A)An S corporation is

Q69: Which AMT adjustment would only be negative?

A)Loss

Q71: Owl Corporation,a calendar year taxpayer,has a beginning

Q72: Which of the following items will have

Q73: A small corporation with unused minimum tax

Q92: The exemption amount is phased out entirely

Q97: What amount of accumulated earnings of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents