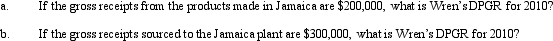

Wren Corporation,a calendar year taxpayer,manufactures and sells candles.It has several factories in the U.S.and one in Jamaica.During 2010,it had DPGR of $4.1 million from the U.S.factories.

Correct Answer:

Verified

Q80: Gem Corporation,a calendar year taxpayer,has AMTI (before

Q82: a. Calculate the personal holding company tax

Q84: Baker Corporation manufactures and sells birdhouses and

Q86: In each of the following independent situations,calculate

Q87: Rohan,Inc. ,a calendar year closely held corporation,is

Q88: Swan Corporation has gross receipts of $3

Q101: Explain the wages limitation.

Q101: What is personal holding company income?

Q103: With respect to the AMT, what is

Q104: Why is the DPAD benefit somewhat unique?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents