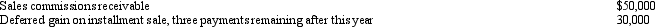

Bob is one of the income beneficiaries of the LeMans Estate,which is subject to a 45% marginal Federal estate tax rate,a 35% marginal Federal income tax rate,and a 5% marginal state income tax rate.This year,Bob received all of the sales commissions that were earned and payable to Violet LeMans (cash basis)at her death.Compute Bob's § 691(c)deduction for the current year,given the following data.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: To reduce trustee commissions,the Emily Trust is

Q71: The trust instrument provides that Tamara,the sole

Q84: With respect to a timely filed Form

Q88: Complete the chart below,indicating trust accounting income

Q90: The Williamson Estate generated distributable net income

Q91: The Raven Trust was terminated this year

Q91: The Code defines a grantor trust as

Q98: The LMN Trust is a simple trust

Q100: Which of the following restrictions applies concerning

Q102: The Prasad Trust operates a welding business.Its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents