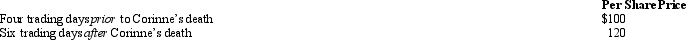

At the time of her death in 2009,Corinne owned stock in Gray Corporation.The stock is traded on a local exchange with the most recent selling prices as follows.

Presuming no alternate valuation date election,Corinne's gross estate should include a per share value of:

A) $108.

B) $110.

C) $112.

D) $120.

E) None of the above.

Correct Answer:

Verified

Q33: A donee's income tax basis in property

Q38: Two years prior to death,a decedent makes

Q40: Audrey made taxable gifts of cash in

Q42: Which,if any,of the following statements reflects the

Q44: Paula owns an insurance policy on her

Q46: A decedent owned 25% of the voting

Q47: Which of the following independent statements correctly

Q48: Which,if any,of the following factors should reduce

Q49: Because of the estate tax deduction, a

Q59: The deferral approach to the estate tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents