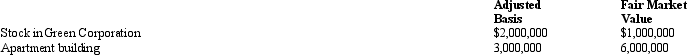

Sam and Lucinda are husband and wife and have always lived in a community property state.At the time of Lucinda's prior death,part of their community property includes:

Under Lucinda's will,all of her property passes to Sam.After Lucinda's death,Sam's income tax basis in this property is:

A) $3,500,000.

B) $4,000,000.

C) $5,000,000.

D) $7,000,000.

E) $8,000,000.

Correct Answer:

Verified

Q43: For the IRS to grant a discretionary

Q51: In satisfying the more-than-35% test of §

Q55: Several years ago, Tad purchased land listing

Q56: If § 6166 applies,a 2% rate of

Q58: Mitzi dies in 2009 owning assets of

Q61: At the time of his death, Harvey

Q63: Which,if any,of the following statements correctly reflects

Q65: In 1986,Jude,a resident of New Jersey,purchases realty

Q73: In a typical estate freeze involving family

Q74: Which statement is correct concerning the rules

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents