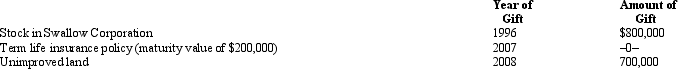

Prior to his death in 2009,Cameron made the following taxable gifts.

The policy of Cameron's life was given to the designated beneficiary.The gift of the stock and the land generated gift taxes of $28,750 and $64,250,respectively.

As to these transfers,how much is included in Cameron's gross estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: In 1985,Drew creates a trust with $1,000,000

Q133: As reflected by the tax law,Congressional policy

Q134: At the time of her death in

Q135: Jordan owns an insurance policy on the

Q136: In 2000,Murray and Pearl acquire real estate

Q137: At the time of his death on

Q140: In 1990,Ethan and Andrea acquire realty for

Q141: Community property law has been influential in

Q143: Distributions from retirement plans and proceeds from

Q149: For Federal estate tax purposes, the gross

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents