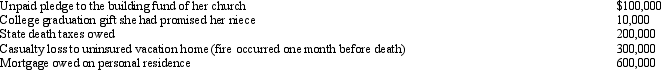

At the time of her death in 2009,Jennifer owns property worth $4,500,000.Other information regarding her affairs is as follows.

All of these items (except the casualty loss)were paid by her estate and none were deducted on Form 1041 (income tax return of the estate).What is Jennifer's taxable estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Michael and Addison are married and have

Q118: Pursuant to Corey's will,Emma (Corey's sister) inherits

Q122: Bernard's will passes $800,000 of cash to

Q126: At the time of Cal's death in

Q129: Among the assets included in Taylor's gross

Q132: At the time of her death on

Q133: As reflected by the tax law,Congressional policy

Q134: At the time of her death in

Q135: Jordan owns an insurance policy on the

Q138: Alvin and Lindsay are husband and wife

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents