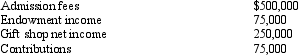

First Americans,Inc. ,a § 501(c)(3)organization,operates a museum which depicts the lives of a tribe of Native Americans.It charges an admission fee,but also finances its operations through endowment income,contributions,and gift shop sales.The gift shop is operated by 60 volunteers and the museum is operated by 10 employees.Revenue by source is:

Determine the amount of First Americans' unrelated business income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: The Dispensary is a pharmacy that is

Q83: Country,Inc. ,an exempt organization,has included among other

Q85: Soft,Inc. ,a § 501(c)(3)organization,has been leasing a

Q88: Help,Inc. ,a tax-exempt organization,incurs lobbying expenses of

Q89: Assist,Inc. ,a § 501(c)(3)organization,receives the following sources

Q89: Which of the following statements regarding exempt

Q93: Miracle, Inc., is a § 501(c)(3) organization

Q97: Spirit,Inc. ,a § 501(c)(3)organization,is classified as a

Q113: Watch, Inc., a § 501(c)(3) exempt organization,

Q120: Arbor, Inc., an exempt organization, leases land,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents