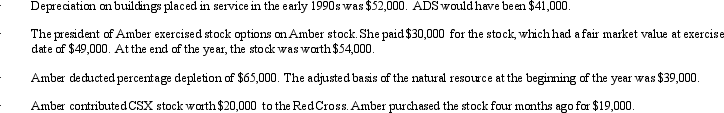

Amber,Inc. ,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.

What is Amber's AMTI?

A) $212,000.

B) $233,000.

C) $238,000.

D) $249,000.

E) None of the above

Correct Answer:

Verified

Q47: Techniques that can be used to minimize

Q53: It is easier to satisfy the §

Q59: Wally contributes land (adjusted basis of $30,000;fair

Q61: Angie has a 60% ownership interest in

Q62: Which of the following is descriptive of

Q63: Which of the following statements regarding the

Q67: Tonya contributes $150,000 to Swan,Inc.,for 75% of

Q69: Rocky and Sandra (shareholders) each loan Eagle

Q72: Steve and Karen are going to establish

Q79: Aaron purchases a building for $500,000 which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents