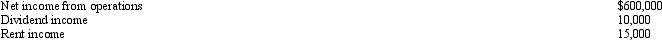

Tuna,Inc. ,a closely held corporation which is not a PSC,owns a 40% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $200,000.During the year,Tuna receives a $60,000 cash distribution from Trout.Other relevant data for Tuna are as follows:

How much of Tuna's share of Trout's loss may it deduct in calculating its taxable income?

A) $0.

B) $25,000.

C) $60,000.

D) $80,000.

E) None of the above.

Correct Answer:

Verified

Q84: Which of the following special allocations are

Q88: Blue,Inc. ,has taxable income before salary payments

Q89: Mr.and Ms.Smith's partnership owns the following assets:

Q90: Kirby,the sole shareholder of Falcon,Inc. ,leases a

Q91: Marcus contributes property with an adjusted basis

Q91: Albert's sole proprietorship owns the following assets:

Q94: Devon owns 30% of the Agate Company

Q95: Bart contributes $100,000 to the Tuna Partnership

Q96: Kristine owns all of the stock of

Q98: Which of the following statements is correct?

A)The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents